IDC expects Canada’s ICT market to slowdown in technology spending in 2020

Alanna Fairey

News Public Sector COVID-19 International Data Corporation (IDC)

The coronavirus outbreak and the necessary containment measures put in place by governments will substantially affect the Canadian IT markets, severely accelerating the impact already felt from the supply-driven effects from Asia.

International Data Corporation (IDC) expects to see a significant slowdown in technology spending in 2020 across Canadian organizations, with IT spending expected to decline by -5.0 per cent. As recently as December 2019, we were projecting a positive 2.4 per cent growth rate for 2020.

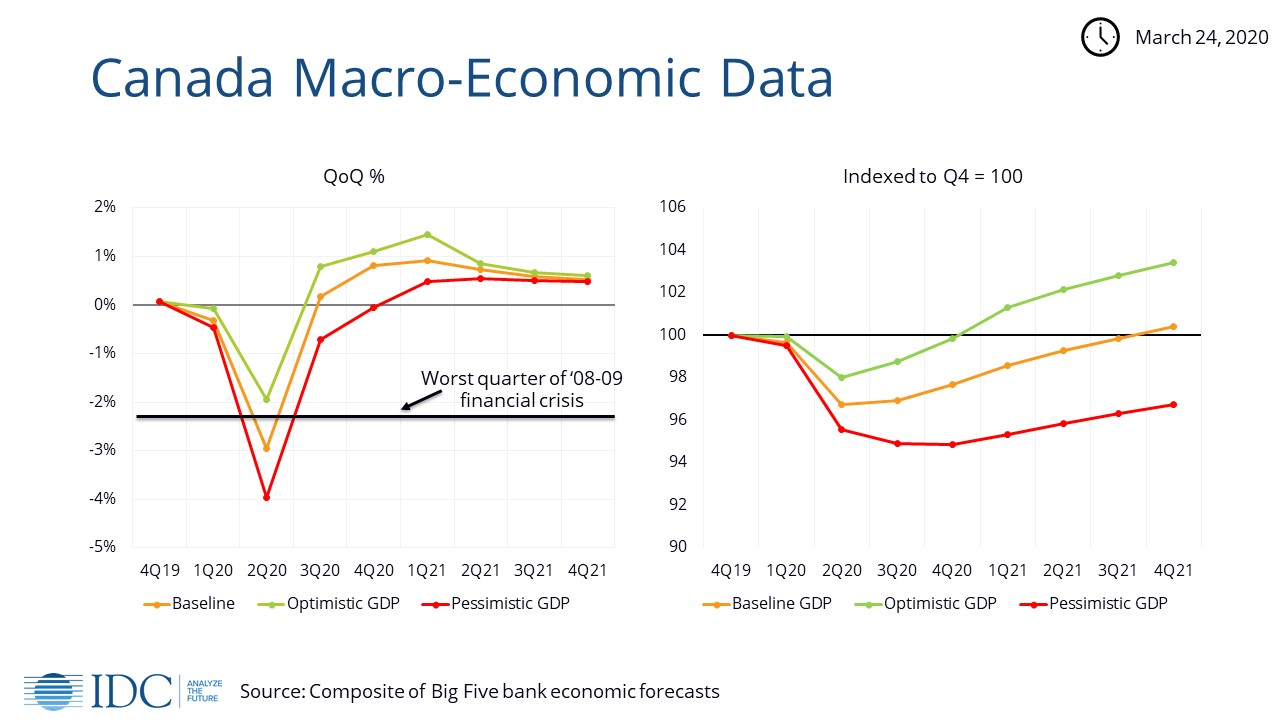

However, with new stringent containment and lockdown measures in place across Canada, resulting in a rapidly deteriorating economic outlook, GDP forecasts have recently been revised down sharply for Q2 and Q3.

“Technology vendors and buyers are rapidly adapting to the disruption and the extremely fast-moving market conditions,” said Nigel Wallis, research vice-president, IoT & Industries at IDC Canada. “In such a rapidly changing environment, it is still too early to assess the overall impact on the Canadian IT market fully. However, given the sharp economic contraction, IDC recommends that all technology leaders recalibrate their strategies.”

IDC Canada has developed three scenarios to help technology providers and buyers with their short-term business and technology investment planning.

In the most probable scenario, IDC projects Canadian IT spending to decline by -5.0 per cent in constant currency terms this year, down from the 2.4 per cent forecast published at the end of 2019.

As restrictions of movement bite, supply-chain disruption becomes commonplace, and demand drops, Canadian IT spending will drop rapidly in Q2. Particularly manufacturing, personal and consumer services, transportation, and hospitality will be sharply curbed, as these industries are the most exposed to the COVID-19 crisis impact.

Other sectors, such as healthcare and government, will be forced to accelerate investments significantly. IDC expects this will drive additional IT investments for the public sector, pushing hard on infrastructure and collaboration tools deployments, but not before the second half of 2020.

In the most pessimistic scenario, IDC expects ICT spending to drop and record a –8.2 per cent decline in 2020, with all technology domains showing negative trends for the remaining part of the year.

Oil price changes, currency depreciation, the inability of governments to make timely payments, delays in the supply chains and significant lay-offs would lead to a much more dramatic impact on the ICT market and an exponential increase in the downside risk in IDC’s market forecast assumptions.

The new outlook is shaped primarily by lower expectations in the hardware and services markets:

- Hardware markets will suffer due to restriction measures hampering supply and overall reduced demand. Client Devices are particularly hit hard, initially because of supply constraints and in later quarters as reduced demand further erode growth.

- The most significant impact on the IT services industry will be a result of businesses postponing decisions on pending projects and slowing the execution of projects in the delivery phase.

Spending reductions on the software and telecoms markets are less pronounced, and some positive factors are expected to moderate the natural downturn somewhat. While the decrease in hardware spending will negatively impact the software market to a degree, difficulties prompted by COVID-19 across industries will impact total telecommunication spending.

The need for remote collaboration will push telecom services demand and drive new opportunities in the collaborative applications and platforms areas, as well as an increase in security technologies that enable them.

The pre-existing digital maturity of industries will also be a factor impacting on their capacity to invest in technologies, regardless of their budget capabilities.

Limited face-to-face business relationships between vendors and end-users will reduce investment in digital transformation projects in less mature industries, and especially for projects involving more advanced technologies.

Social distancing and provincial lock downs will also have consequences on the purchasing options for many consumers.

“Additional factors weighing on investment will range from a decrease in customer demand to supply chains breaking up,” said Meng Cong, manager, market insights & analytics at IDC Canada.

“Nevertheless, there are areas in which spending will grow. In use cases such as patient care as well as customer, citizen, student or employee experience and proximity, we expect to see accelerated adoption of digital solutions. Specific solutions such as videoconferencing, intelligent supply, chatbots, and e-learning platforms, among others, highlight how technology can help businesses and societies address these new challenges.”

Print this page

Advertisement

- Highlights of the British Columbia’s government’s emergency pandemic response

- How Canadian organizations can combat ransomware attacks

Leave a Reply