How customer service and security perceptions are shaping banking consumer choices

By Canadian Security

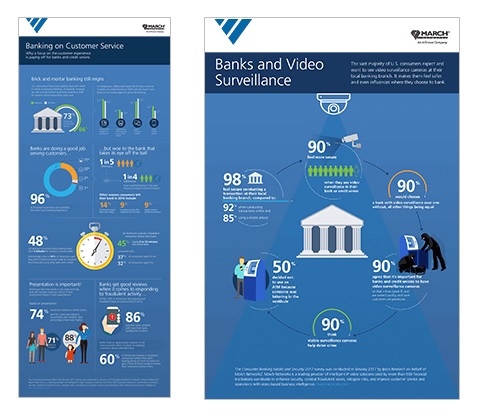

News Industry NewsMarch Networks recently commissioned a survey, conducted by Ipsos, exploring how fraud, customer service and security perceptions are impacting U.S. banking consumer decisions.

The survey revealed that 15 per cent of consumers experienced fraudulent bank account activity in 2016. However, banks and credit unions responded successfully, with 85 per cent of those consumers saying they were satisfied with how their financial institution handled the incident.

The results also showed that a continued focus on customer experience remains critical for banks and credit unions when it comes to retention.

Consumers’ banking choices are influenced by how secure they feel when conducting transactions, either in their local branch, at an ATM or online. A majority of consumers (98 per cent) felt most secure when conducting transactions at their local banking branch, compared to 92 per cent when conducting online transactions and 85 per cent using a mobile app.

Additionally, 90 per cent of consumers said they feel safer when they can see video surveillance cameras in their bank or credit union. Furthermore, they would choose a financial institution with surveillance over one without, all other things being equal.

Print this page

Advertisement

- Security Director of the Year Gala 2017

- Six year, $760M spending for Canadian embassy security in fiscal update

Leave a Reply